Over the past decade, the global activewear industry experienced rapid growth. But according to McKinsey's Sporting Goods 2025 report, this pace is shifting. While the market grew at an annual rate of 7% between 2021 and 2024, projections show a slight slowdown to 6% by 2029. Rather than signaling a decline, this marks a transition—from competing on speed and scale to balancing growth with operational efficiency and long-term value.

Trend 1: Cultural Identity Is Overtaking Pure Performance

Activewear is no longer just about performance—it’s now an expression of lifestyle and identity. For Gen Z and millennials, movement is personal. Products must resonate with their values, communities, and cultural codes.

Porlite’s sustainable functional fabrics are designed to meet both the performance needs of active lifestyles and the evolving expectations of modern consumers. Crafted from recyclable and decomposable microporous PP membranes, Porlite not only delivers technical functionality for outdoor and urban use, but also resonates with those seeking approachable, low-pressure ways to stay active. It supports a shift toward a more inclusive, lifestyle-oriented vision of movement—where performance and comfort coexist naturally.

Trend 2: Brands Must Serve Both Extremes of the Evolving Market

Entry-level or inactive consumers—projected to make up 35% of the global population by 2030 —represent not just an overlooked segment, but one of the most promising growth frontiers for forward-thinking brands.

Porlite bridges the market divide by aligning with today’s values—sustainability, comfort, and style. Its lightweight build, vibrant colors, and refined texture support both fashionable and functional designs. From technical outerwear to everyday activewear, Porlite empowers brands to deliver eco-conscious performance that fits seamlessly into modern lifestyles.

Trend 3: Challenger Brands Are Redefining the Playing Field

Between 2019 and 2024, market giants like Nike and adidas lost approximately 3% of their global market share. In contrast, focused challenger brands—Lululemon, Hoka, On, Arc’teryx —gained ground by targeting niche segments and aligning tightly with consumer identity.

Porlite, while rooted in the B2B supply chain, fosters partnerships through co-creation— offering support from material selection to recyclability. Though priced above entry-level options, its microporous PP membrane delivers high garment yield—up to 69.4 pieces per kilogram—alongside low energy consumption, reduced waste, and recyclable properties. For brands focused on differentiation and long-term value, Porlite is a smart, future-ready choice.

Trend 4: From Selling Products to Creating Experiences

According to Grand View Research, the global event ticketing market is expected to hit $150 billion by 2030. Consumers are increasingly drawn to brands that deliver not just goods, but real-world experiences.

We encourage our brand partners to bring co-created garments into immersive settings—like water sports, urban events, or outdoor workshops—turning each piece into a lifestyle expression. In doing so, your products become more than apparel; they become an extension of your story and a meaningful part of the consumer’s world. The future of activewear isn’t just about technical apparel—it’s about understanding people’s rhythms, values, and aspirations !

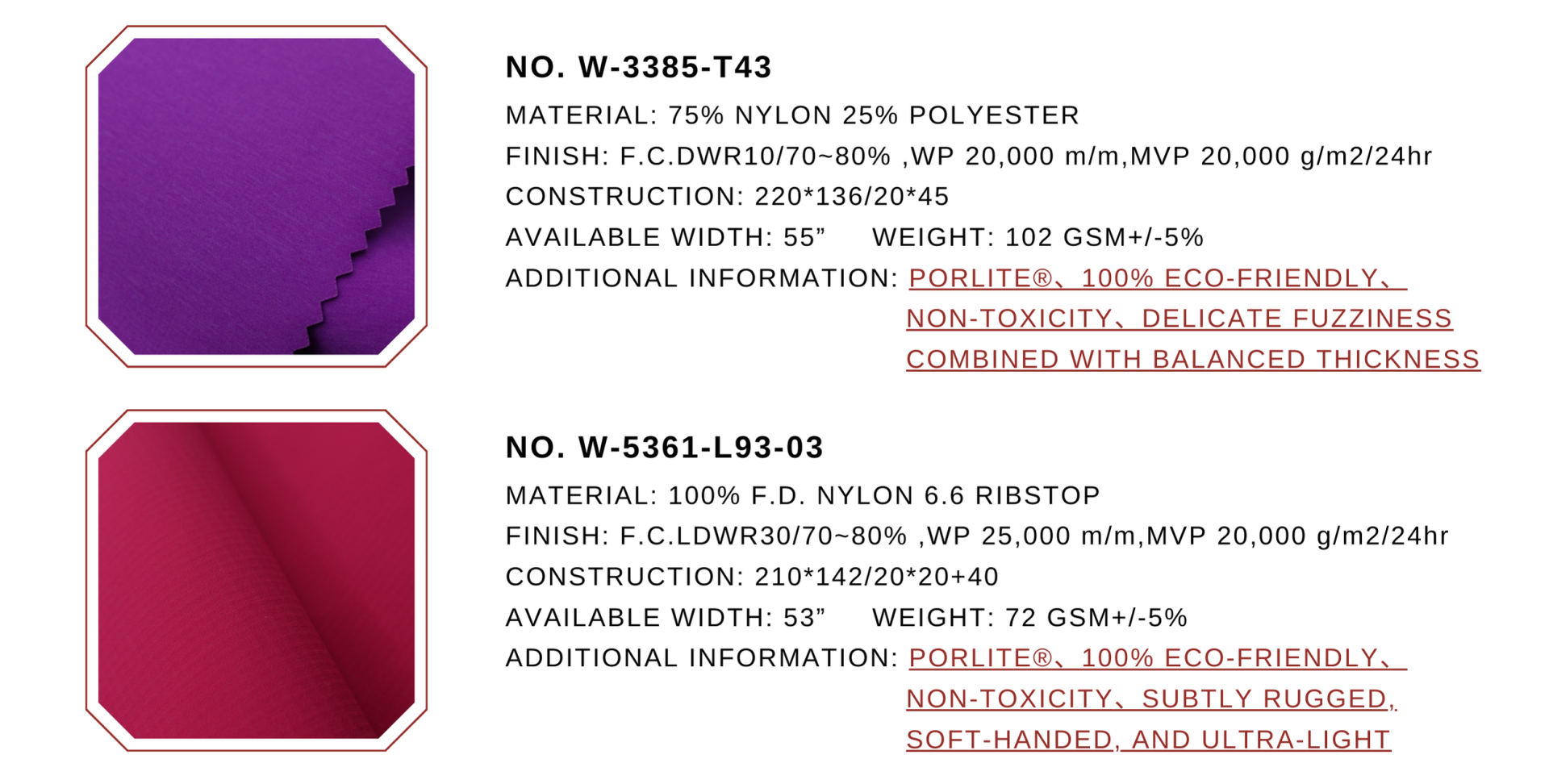

Fabric Recommendations